M&A Carve-outs

Cross-border carve-out activity continues to flourish, as corporations, private equity firms and others take advantage of favorable buying conditions, including rises in equity markets and relatively low borrowing costs. Buyers are motivated to extend their geographic reach, acquire a complimentary line of business and expand their customer base.

Growth through M&A is a complicated, risky, and all too often confusing game. Layer in the transaction that takes the buyer to countries they haven’t operated in previously, and things can get messy quickly.

How to deliver successful cross border carve-outs.

Are you ready to master the art of successful cross-border carve-outs? Unlock the secrets to seamless transitions and strategic maneuvers in our comprehensive eBook

Proudly Supporting

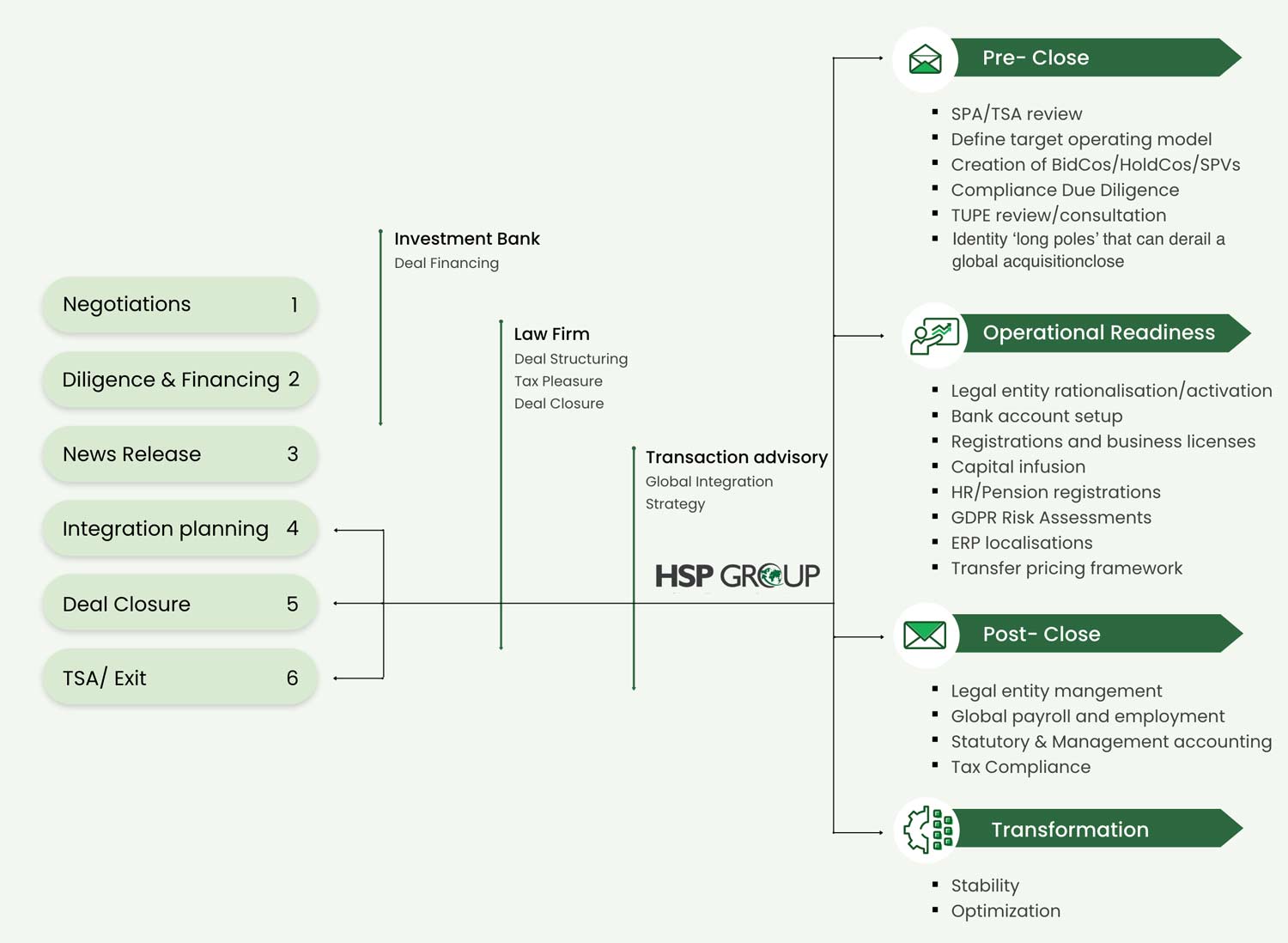

HSP experts can help with every stage of your carveout, including:

Pre-Close

Operational Readiness

Post-Close

Transformation

Don’t Wait! Get Connected Today

01

Pre-Close

02

Operational Readiness

As the transaction close approaches, a compliant back-office infrastructure needs to be established. Given the importance of hitting the transaction close date, often is the case where the operating model Day 1 places a premium on speed to set up, whereas Day 2 may look different. Key questions for buyers to ask:

- What is our legal entity rationalization strategy?

- Do we have the necessary employer registrations in place to pay employees as of the close date?

- Are there GDPR considerations we now need to be aware of?

- How are technology systems going to integrate post-close?

03

Post-Close

Executing the integration of a carveout is one of the most difficult assignments in the M&A lifecycle. The only way to ensure success is to have a global partner steeped in M&A transactions. Most buyers in cross-border carveouts fail to realize that some countries require statutory filings to be handed over in-person or contracts must be written in the native language. Both the buyer and seller organizations have undergone significant change and now the buyer is officially on the hook for making the integration, and more importantly the market facing reality, as seamless as possible. Having a partner that can both execute Global Entity Solutions and Global People Solutions , while also having an eye towards and end goal of transforming the back-office will greatly help with the integration.

04

Transformation

The transformation phase of a carveout is about reducing complexity in day-to-day operations and providing the necessary support for the newly merged business to capitalize on the market synergies that created the original hypothesis for the deal. However, the larger the deal, and the more countries it involves, the more complicated it will become. Integration budgets can be eaten up by implementing global systems. Managing multiple vendors involved in accounting, payroll and compliance can stress internal resources. Having a single point of contact coordinating the day-to-day management of outsourced operations can greatly accelerate the transformation. Whereas the focus during Operational Readiness was simply on standing up operations to enable the transaction to close, now Global Entity and Global People Solutions should be optimized.