Your Ireland Expansion Experts: EoR HR Payroll Compliance Books

Enter the Irish market confidently with HSP Group. When it comes to financial bookkeeping, employer of record services, comprehensive human resources management, stringent compliance adherence, and meticulous payroll management – we’ve got you covered.

Speak to an Expert

Trusted by the most successful businesses in the world.

Your Ireland Expansion Experts: EoR HR Payroll Compliance Books

Enter the Irish market confidently with HSP Group. When it comes to financial bookkeeping, employer of record services, comprehensive human resources management, stringent compliance adherence, and meticulous payroll management – we’ve got you covered.

Speak to an Expert

Trusted by the most successful businesses in the world.

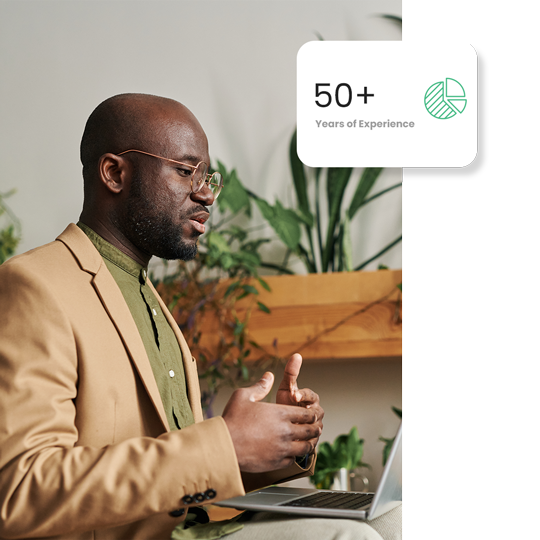

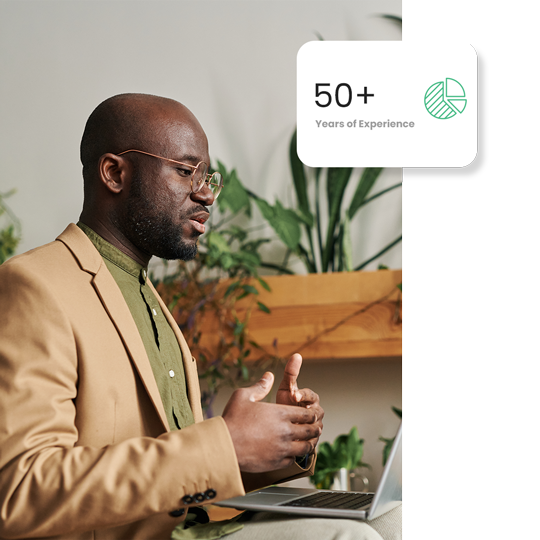

Empowering Global Teams: From HR to Payroll Precision

HSP provides full-service international payroll processing to ensure that your employees’ pay is calculated correctly, your employees are paid on time, every time, and all required payroll compliance filings are managed seamlessly and efficiently.

Our services include standalone payroll, Employer of Record (EoR), Professional Employment Organization (PEO), Non-Resident Employer payroll – circumstances and local law permitting, – Employment tax guidance, and employee expense report support.

HSP provides full-service international payroll processing to ensure that your employees’ pay is calculated correctly, your employees are paid on time, every time, and all required payroll compliance filings are managed seamlessly and efficiently.

Our services include standalone payroll, Employer of Record (EOR), Professional Employment Organization (PEO), Non-Resident Employer payroll (circumstances and local law permitting), employment tax guidance, and employee expense report support.

Managing a mobile international workforce, whether for short-term or long-term assignments, can add further challenges to your HR function. Through our Global Mobility Consulting group, HSP supports your company’s global mobility and expatriate strategy needs and helps you navigate the complex home, host, and cross-border country requirements.

HSP helps you prepare to send an employee overseas and helps you and the employee stay compliant while living and working abroad.

Designed to extend your in-country HR capabilities, our HR Administration services provide recurring HR support to address those common challenges associated with hiring, onboarding, paying, providing benefits, offboarding and answering the myriad of employment-related questions for your international employees.

By syncing up both the HR and the Payroll function, we ensure that you have a seamless and comprehensive solution.

Our technical consulting services address the challenges facing today’s global marketplace by assisting clients in establishing the appropriate structures to manage and support their workforce.

We understand country-specific HR and Employment best practices, compensation and flexible working packages, understanding benefits requirement and benefits sourcing, performance management, leave policies and termination/redundancy assistance.

Empowering Global Teams: From HR to Payroll Precision

HSP provides full-service international payroll processing to ensure that your employees’ pay is calculated correctly, your employees are paid on time, every time, and all required payroll compliance filings are managed seamlessly and efficiently.

Our services include standalone payroll, Employer of Record (EoR), Professional Employment Organization (PEO), Non-Resident Employer payroll – circumstances and local law permitting, – Employment tax guidance, and employee expense report support.

HSP provides full-service international payroll processing to ensure that your employees’ pay is calculated correctly, your employees are paid on time, every time, and all required payroll compliance filings are managed seamlessly and efficiently.

Our services include standalone payroll, Employer of Record (EOR), Professional Employment Organization (PEO), Non-Resident Employer payroll (circumstances and local law permitting), employment tax guidance, and employee expense report support.

Managing a mobile international workforce, whether for short-term or long-term assignments, can add further challenges to your HR function. Through our Global Mobility Consulting group, HSP supports your company’s global mobility and expatriate strategy needs and helps you navigate the complex home, host, and cross-border country requirements.

HSP helps you prepare to send an employee overseas and helps you and the employee stay compliant while living and working abroad.

Designed to extend your in-country HR capabilities, our HR Administration services provide recurring HR support to address those common challenges associated with hiring, onboarding, paying, providing benefits, offboarding and answering the myriad of employment-related questions for your international employees.

By syncing up both the HR and the Payroll function, we ensure that you have a seamless and comprehensive solution.

Our technical consulting services address the challenges facing today’s global marketplace by assisting clients in establishing the appropriate structures to manage and support their workforce.

We understand country-specific HR and Employment best practices, compensation and flexible working packages, understanding benefits requirement and benefits sourcing, performance management, leave policies and termination/redundancy assistance.

Ireland Awaits Your Business

Experience HSP’s expert solutions for cross-border payroll, and entity management solutions. Simplify your complexities abroad.

CASE STUDY

Acquia leverages a single global provider, equipped to handle all the company’s people and entity needs.

Running Payroll in

Streamlined Success: Entity Management and Beyond

HSP’s Legal Management services include entity requirement analysis and selection, incorporation and post-establishment corporate income tax, indirect tax, and other registrations and licenses. In addition, our services are designed to keep your entity operational and compliant by providing ongoing corporate secretarial support, maintenance and custody of legal records and corporate books, tax agent representation, registered office address, and annual legal compliance.

At HSP, we understand that a company must fulfill local accounting obligations while also reporting on consolidated results to investors and leadership team. With this in mind, HSP Group can assist with both the preparation of local statutory bookkeeping and Financial Reporting – that is, in local GAAP, local currency and local language, and management reporting – considering management entries, and in English.

One of the main things that keep our clients up at night is worry about whether their overseas entities are reporting, filing and paying the correct taxes in each of their respective jurisdictions. HSP’s Tax Compliance takes this burden away from our clients. Our services include both indirect (Sales Tax, VAT, GST, IVA) and direct (CIT and WHT) taxes filing preparation and submission, pre-tax assessment review, tax recovery and tax audit support.

HSP’s technical consulting services is customized to support your business to prevent and resolve many different challenges you will encounter while operating overseas. It is also designed to assist you in scaling operations and developing more efficient and compliant processes in each of your overseas locations.

Streamlined Success: Entity Management and Beyond

HSP’s Legal Management services include entity requirement analysis and selection, incorporation and post-establishment corporate income tax, indirect tax, and other registrations and licenses. In addition, our services are designed to keep your entity operational and compliant by providing ongoing corporate secretarial support, maintenance and custody of legal records and corporate books, tax agent representation, registered office address, and annual legal compliance.

At HSP, we understand that a company must fulfill local accounting obligations while also reporting on consolidated results to investors and leadership team. With this in mind, HSP Group can assist with both the preparation of local statutory bookkeeping and Financial Reporting – that is, in local GAAP, local currency and local language, and management reporting – considering management entries, and in English.

One of the main things that keep our clients up at night is worry about whether their overseas entities are reporting, filing and paying the correct taxes in each of their respective jurisdictions. HSP’s Tax Compliance takes this burden away from our clients. Our services include both indirect (Sales Tax, VAT, GST, IVA) and direct (CIT and WHT) taxes filing preparation and submission, pre-tax assessment review, tax recovery and tax audit support.

HSP’s technical consulting services is customized to support your business to prevent and resolve many different challenges you will encounter while operating overseas. It is also designed to assist you in scaling operations and developing more efficient and compliant processes in each of your overseas locations.

FAQs

There’s no local bank account needed.

Yes, local representation is required.

The standard payroll frequency is monthly/weekly.

No, local registration isn’t required.

The employer taxes are 8.8% – 11.05% of gross salary.

Don’t Wait! Get Connected Today

Good to Know

All Irish companies must have an EEA-resident director. If not available within the organization, the company can either: (1) engage a local as a nominee director; (2) take out a S137 insurance bond to cover fines and penalties by the Irish Companies Registration Office (CRO) or tax authority; or (3) apply for an exemption.

Employers must contribute to social security (PRSI) in Ireland. The rate for most employees is 11.05% of their gross salary. Starting in 2024, Ireland will introduce pension auto-enrollment; employers will be required to contribute 1.5% of gross salary. Both rates are low in an EU context.

To be a tax resident in Ireland, companies must be managed and controlled from there. There are no set criteria, so factors like board meeting locations are very important. Ireland has an extensive tax treaty network, and tax withholding on dividends to foreign group companies is typically nil.

Opening Bank Account

Although having an Irish bank account is not a legal requirement, the lack of one can create logistical difficulties, particularly with the Revenue office (tax authority). Opening an account with a local bank can take months; however, attendance in person by the directors can expedite the process.

Managing Payroll

Ireland operates a real-time reporting payroll system, which means that employees should not be paid until the associated filings are made to the Revenue office. Corporate tax registration is straightforward but there can be delays in obtaining PPS (social security) numbers for non-nationals who have not worked in Ireland.

Understanding Rights

As with any EU jurisdiction, employees have strong protections under the employment law framework. It is important employers understand those rights (e.g. around maternity leave, sick pay, redundancy entitlements) from the start and ensure that proper procedures are implemented and documented.

Next Steps

You don’t know what you don’t know — and that’s where our local expertise comes in. Our expert-led managed services and technical consulting are designed to help you thrive in Ireland and throughout the world, regardless of regulatory complexity.

We back up our expertise with GateWay, our pioneering global expansion management system (GXM) that empowers you to effortlessly and compliantly manage your international footprint. This platform is your one-stop-shop for global growth.

“While local vendors tend to primarily care about their sliver of the business, HSP Group is, as the single provider, fully invested in the success of the entire organization.”

Head of Finance and Operations at a fast-growing FinTech