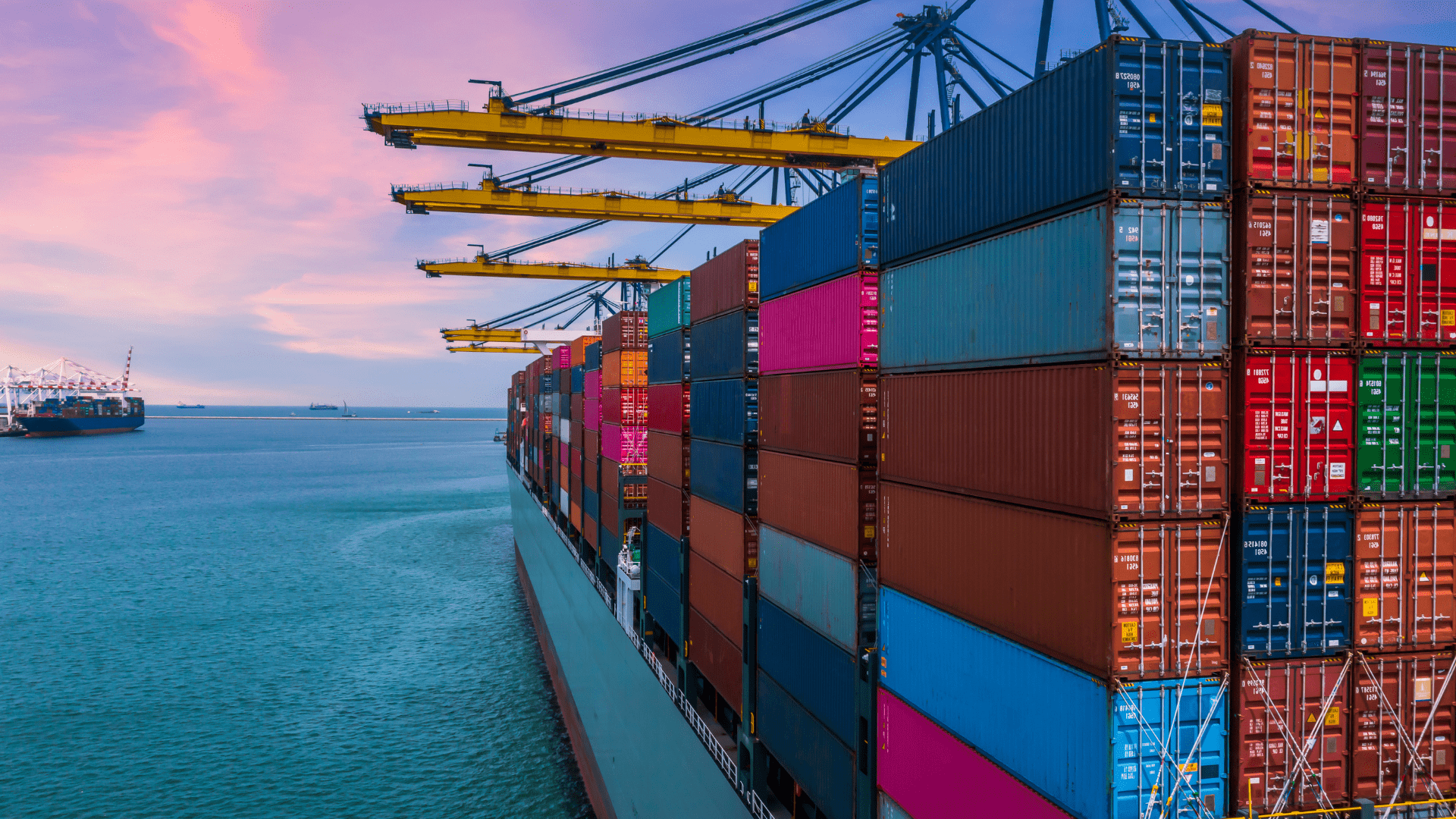

Lack of secure communication is common, elevating the risk of both breaches and noncompliance when managing payrolls across the globe

For all the news about data breaches and million-dollar fines for data privacy violations, a surprisingly large number of companies still send emails that include Personal Identifiable Information (PII). In some cases, the practice may stem from a lack of knowledge of the laws in other countries or regions. In other words, a US company operating in the EU will not necessarily know what their obligations are under GDPR for their European operations. Other times, the company’s fragmented organizational structure may be to blame for the haphazard data handling.

Two challenges to global payroll compliance

For global companies, it’s typically the latter that leaves them vulnerable when managing payroll in different countries. With no streamlined or secure way to share employee data, problems can arise on two fronts:

Too many vendors

When a company scales, the number of vendors tends to proliferate. And the more systems and people are involved, the harder data security becomes, especially if there’s no central point of contact through which communication securely flows.

Employee mistakes are, at 88%, by far the leading cause of data breaches, according to a study by Stanford researchers and a top cybersecurity organization. The rise of hybrid or remote work has further underscored this trend. More than half of the respondents said they are more distracted at home and then cited “distraction” as the primary reason for falling for email phishing scams that they thought came from senior executives or well-known brands.

2. Inadequate data protection

Local vendors contracted by global companies can be under the false impression that their risk exposure is low due to their smaller size. Therefore, they may not invest in the tools and processes necessary to ensure complete data protection. They may let personal data languish in an inbox or use email as their main vehicle for communication about payroll matters. The global company, in turn, does not consider the risks – it seems to be working after all – until it’s too late.

You can’t ignore data protection laws

Just about every country in the world has some form of data protection laws and they vary widely across borders. Although not every incident involving personal data may catch the eye of regulators, it does increase the potential attack surface that bad actors can exploit. If an email is also accidentally sent to the wrong addressee, the situation can quickly unravel.

Over the last 10 years, international requirements have tightened, especially for foreign entities. Many global companies may not realize that data privacy laws place the responsibility for compliant data processing on them even when done by third parties that they contract with.

With steep fines, penalties, and your company’s reputation and future viability at stake, compliant global payroll processing is foundational to your business. This means you must comply with applicable data protection laws. Three of the largest frameworks include:

EU/UK

The General Data Protection Regulation (GDPR) is the “gold standard” for data protection worldwide. GDPR was passed to strengthen data protection for individuals and unify data protection across EU member states. Referred to as UK-GDPR, the UK has adopted laws that are almost identical to GDPR. Bear in mind there’s no such thing as flying under the GDPR radar. Regulators have become very apt at catching violators, and companies must act accordingly.

Brazil

LGPD aligns broadly with GDPR. It consolidates more than 40 different regulations currently in effect. If you are collecting or processing data in Brazil or the data is processed for the purpose of offering goods and services to individuals in the country, the laws apply even if you have US headquarters. The enforcement and penalties started recently.

Mexico

In Mexico, The Federal Law on the Protection of Personal Data has been around longer than GDPR, but the law is not well defined and enforcement with real consequences is rare. There’s also a gap in the law related to legitimate interest. At this point, there are no plans to change the federal laws to make them more enforceable. Instead, the task falls on states to create laws to protect data.

How the right technology can ensure data compliance

Safeguarding the personal information of your employees should be part of your company’s DNA. To ensure no piece of personal data slips into the wrong hands and to achieve compliance, internal communication, and data sharing must be airtight. That means email cannot be used at any point. Instead, consider the benefits of using a secure, cloud-based platform with multi-factor authentication to which only the right people have access.

A platform that unifies all of your applications in a single place eliminates the need to manage different systems for payroll, HR, accounting, statutory compliance, and anything else required to run your global business. When all communication takes place in this secure environment, threats like phishing and other scams become non-issues.

We can help

Does your global payroll comply with data privacy laws? We are here to help. HSP Group combines an unparalleled focus on the client experience with GateWay, our pioneering global expansion management platform which comes with compliance and secure communication built in. Let’s go global with ease.

Read more:

Why data privacy compliance is so crucial to international success?

Watch: Why every business should care about data privacy laws