Your Mexico Expansion Experts: EoR HR Payroll Compliance Books

Enter the Mexican market confidently with HSP Group. When it comes to financial bookkeeping, employer of record services, comprehensive human resources management, stringent compliance adherence, and meticulous payroll management – we’ve got you covered.

Speak to an Expert

Trusted by the most successful businesses in the world.

Your Mexico Expansion Experts: EoR HR Payroll Compliance Books

Enter the Mexican market confidently with HSP Group. When it comes to financial bookkeeping, employer of record services, comprehensive human resources management, stringent compliance adherence, and meticulous payroll management – we’ve got you covered.

Speak to an Expert

Trusted by the most successful businesses in the world.

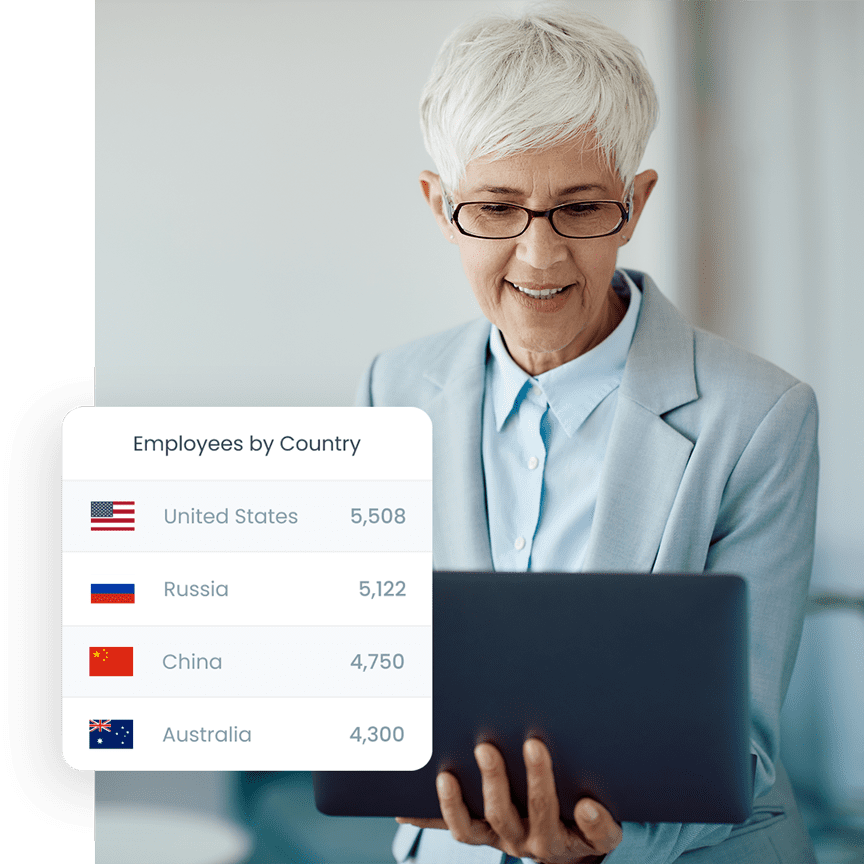

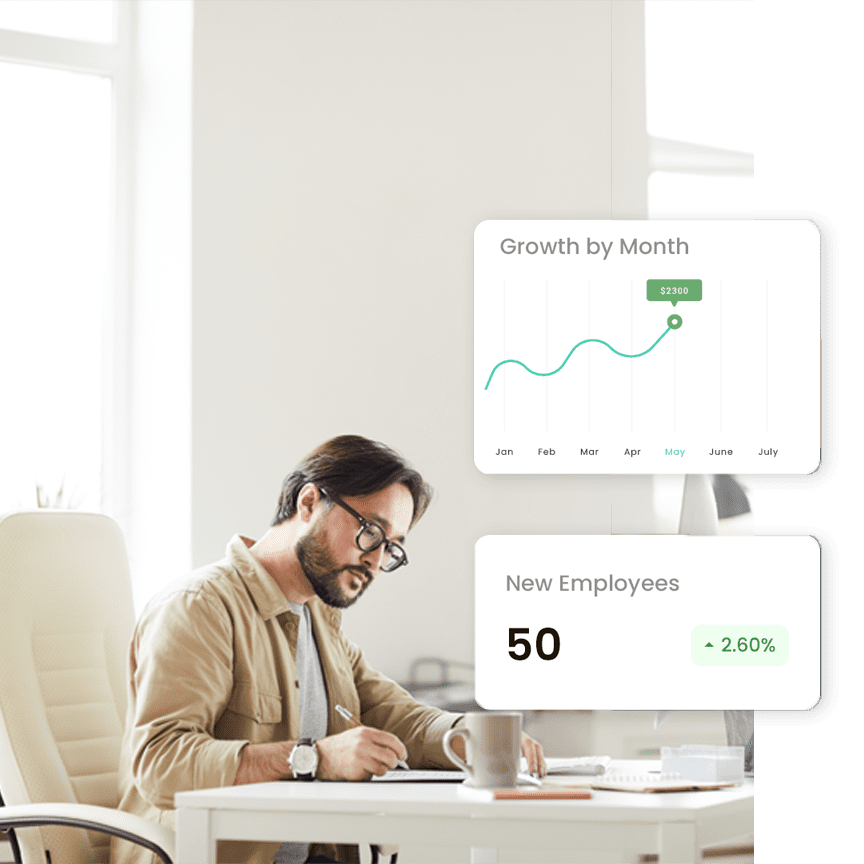

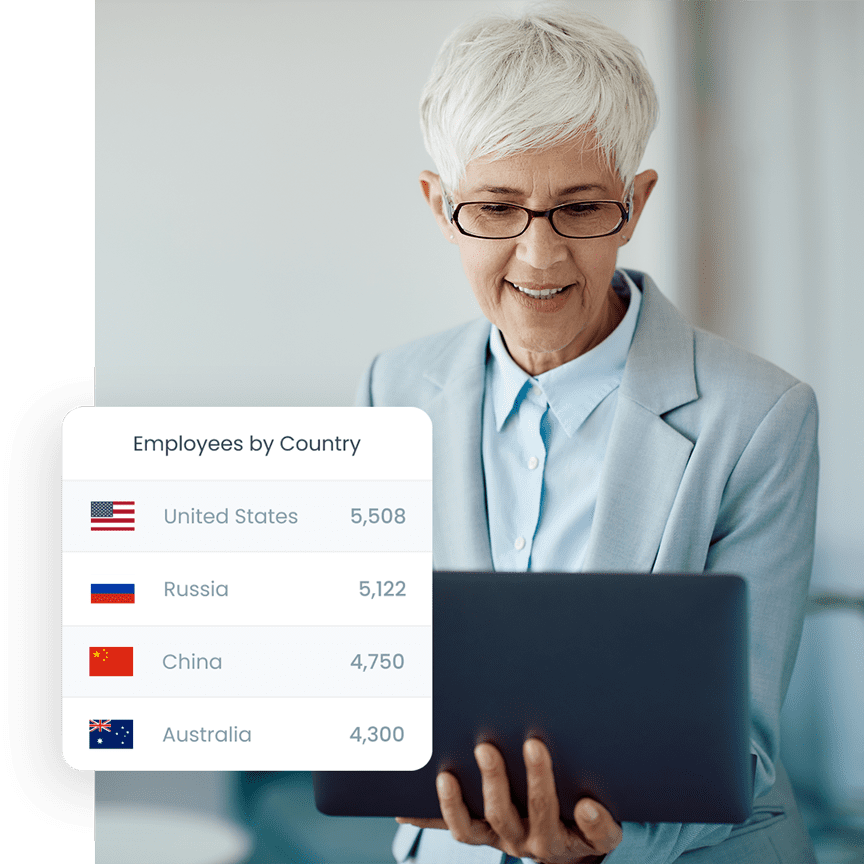

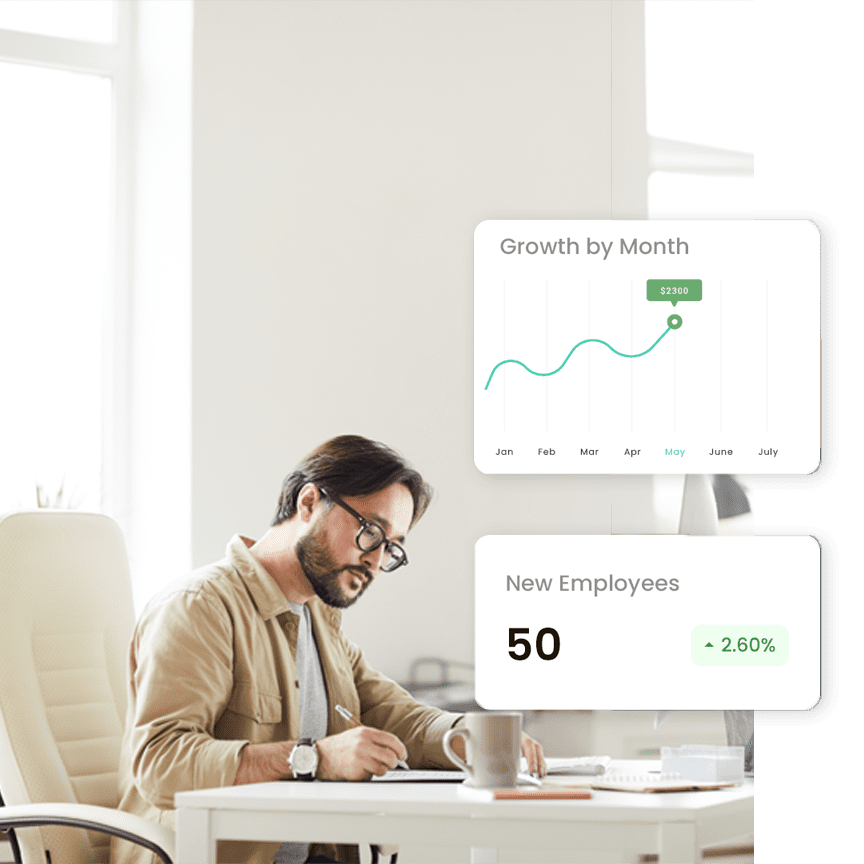

Empowering Global Teams: From HR to Payroll Precision

HSP provides full-service international payroll processing to ensure that your employees’ pay is calculated correctly, your employees are paid on time, every time, and all required payroll compliance filings are managed seamlessly and efficiently.

Our services include standalone payroll, Employer of Record (EoR), Professional Employment Organization (PEO), Non-Resident Employer payroll – circumstances and local law permitting, – Employment tax guidance, and employee expense report support.

HSP provides full-service international payroll processing to ensure that your employees’ pay is calculated correctly, your employees are paid on time, every time, and all required payroll compliance filings are managed seamlessly and efficiently.

Our services include standalone payroll, Employer of Record (EOR), Professional Employment Organization (PEO), Non-Resident Employer payroll (circumstances and local law permitting), employment tax guidance, and employee expense report support.

Managing a mobile international workforce, whether for short-term or long-term assignments, can add further challenges to your HR function. Through our Global Mobility Consulting group, HSP supports your company’s global mobility and expatriate strategy needs and helps you navigate the complex home, host, and cross-border country requirements.

HSP helps you prepare to send an employee overseas and helps you and the employee stay compliant while living and working abroad.

Designed to extend your in-country HR capabilities, our HR Administration services provide recurring HR support to address those common challenges associated with hiring, onboarding, paying, providing benefits, offboarding and answering the myriad of employment-related questions for your international employees.

By syncing up both the HR and the Payroll function, we ensure that you have a seamless and comprehensive solution.

Our technical consulting services address the challenges facing today’s global marketplace by assisting clients in establishing the appropriate structures to manage and support their workforce.

We understand country-specific HR and Employment best practices, compensation and flexible working packages, understanding benefits requirement and benefits sourcing, performance management, leave policies and termination/redundancy assistance.

Empowering Global Teams: From HR to Payroll Precision

HSP provides full-service international payroll processing to ensure that your employees’ pay is calculated correctly, your employees are paid on time, every time, and all required payroll compliance filings are managed seamlessly and efficiently.

Our services include standalone payroll, Employer of Record (EoR), Professional Employment Organization (PEO), Non-Resident Employer payroll – circumstances and local law permitting, – Employment tax guidance, and employee expense report support.

HSP provides full-service international payroll processing to ensure that your employees’ pay is calculated correctly, your employees are paid on time, every time, and all required payroll compliance filings are managed seamlessly and efficiently.

Our services include standalone payroll, Employer of Record (EOR), Professional Employment Organization (PEO), Non-Resident Employer payroll (circumstances and local law permitting), employment tax guidance, and employee expense report support.

Managing a mobile international workforce, whether for short-term or long-term assignments, can add further challenges to your HR function. Through our Global Mobility Consulting group, HSP supports your company’s global mobility and expatriate strategy needs and helps you navigate the complex home, host, and cross-border country requirements.

HSP helps you prepare to send an employee overseas and helps you and the employee stay compliant while living and working abroad.

Designed to extend your in-country HR capabilities, our HR Administration services provide recurring HR support to address those common challenges associated with hiring, onboarding, paying, providing benefits, offboarding and answering the myriad of employment-related questions for your international employees.

By syncing up both the HR and the Payroll function, we ensure that you have a seamless and comprehensive solution.

Our technical consulting services address the challenges facing today’s global marketplace by assisting clients in establishing the appropriate structures to manage and support their workforce.

We understand country-specific HR and Employment best practices, compensation and flexible working packages, understanding benefits requirement and benefits sourcing, performance management, leave policies and termination/redundancy assistance.

Mexico Awaits Your Business

Experience HSP’s expert solutions for cross-border payroll, and entity management solutions. Simplify your complexities abroad.

CASE STUDY

Acquia leverages a single global provider, equipped to handle all the company’s people and entity needs.

Running Payroll in

Streamlined Success: Entity Management and Beyond

HSP’s Legal Management services include entity requirement analysis and selection, incorporation and post-establishment corporate income tax, indirect tax, and other registrations and licenses. In addition, our services are designed to keep your entity operational and compliant by providing ongoing corporate secretarial support, maintenance and custody of legal records and corporate books, tax agent representation, registered office address, and annual legal compliance.

At HSP, we understand that a company must fulfill local accounting obligations while also reporting on consolidated results to investors and leadership team. With this in mind, HSP Group can assist with both the preparation of local statutory bookkeeping and Financial Reporting – that is, in local GAAP, local currency and local language, and management reporting – considering management entries, and in English.

One of the main things that keep our clients up at night is worry about whether their overseas entities are reporting, filing and paying the correct taxes in each of their respective jurisdictions. HSP’s Tax Compliance takes this burden away from our clients. Our services include both indirect (Sales Tax, VAT, GST, IVA) and direct (CIT and WHT) taxes filing preparation and submission, pre-tax assessment review, tax recovery and tax audit support.

HSP’s technical consulting services is customized to support your business to prevent and resolve many different challenges you will encounter while operating overseas. It is also designed to assist you in scaling operations and developing more efficient and compliant processes in each of your overseas locations.

Streamlined Success: Entity Management and Beyond

HSP’s Legal Management services include entity requirement analysis and selection, incorporation and post-establishment corporate income tax, indirect tax, and other registrations and licenses. In addition, our services are designed to keep your entity operational and compliant by providing ongoing corporate secretarial support, maintenance and custody of legal records and corporate books, tax agent representation, registered office address, and annual legal compliance.

At HSP, we understand that a company must fulfill local accounting obligations while also reporting on consolidated results to investors and leadership team. With this in mind, HSP Group can assist with both the preparation of local statutory bookkeeping and Financial Reporting – that is, in local GAAP, local currency and local language, and management reporting – considering management entries, and in English.

One of the main things that keep our clients up at night is worry about whether their overseas entities are reporting, filing and paying the correct taxes in each of their respective jurisdictions. HSP’s Tax Compliance takes this burden away from our clients. Our services include both indirect (Sales Tax, VAT, GST, IVA) and direct (CIT and WHT) taxes filing preparation and submission, pre-tax assessment review, tax recovery and tax audit support.

HSP’s technical consulting services is customized to support your business to prevent and resolve many different challenges you will encounter while operating overseas. It is also designed to assist you in scaling operations and developing more efficient and compliant processes in each of your overseas locations.

FAQs

Yes, local bank account needed.

Yes, local representation is required.

The standard payroll frequency is Monthly, Bi-Monthly.

No, local registration isn’t required.

The employer taxes are 22.75% of gross salary.

Yes, there is mandatory 13th salary.

Don’t Wait! Get Connected Today

Good to Know

Among the labor rights that comprise workers in Mexico, two stand out: Social Security and the annual Christmas bonus, which must be equivalent to at least 15 days of salary. Companies must comply with both.

Companies that provide outsourcing services are mandated to register with the REPSE (Registro de Prestaciones de Servicios u Obras Especializadas) in order to operate in Mexico.

Mexico has 12 trade agreements with 46 countries, providing the opportunity for expansion to more than one billion consumers.

Notable Challenges

Multiple Hoops

Once the company has been incorporated, it must be registered with the Tax Authorities (SAT) and the Social Security Institute (IMSS) in order to operate and employ in Mexico.

Complex Tax Laws

Mexico has the second most complicated tax law in the world. Companies must file both monthly and annual tax declarations. This process demands a considerable amount of time as well as knowledge of how to navigate the Tax Administration Service's digital platform.

Lengthy Company Registration

It can take two to three months — which is twice as long as in developed countries — to register company ownership with the Public Registry. In addition, the time frame varies according to the specific geographic area where the company will be established.

Next Steps

We can help you navigate the complex regulatory environment in Mexico. Our expert-led managed services and technical consulting were designed to help you expand with ease.

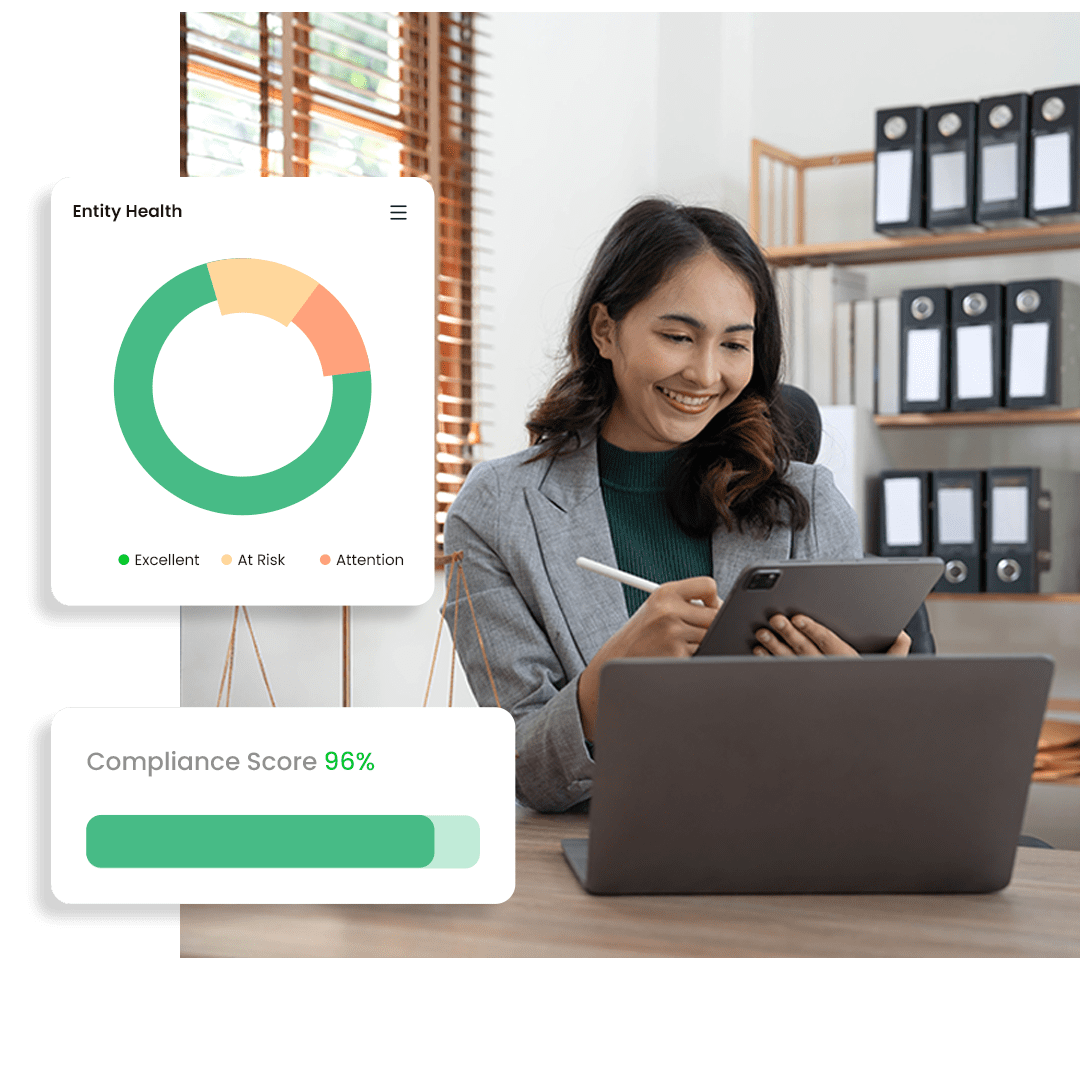

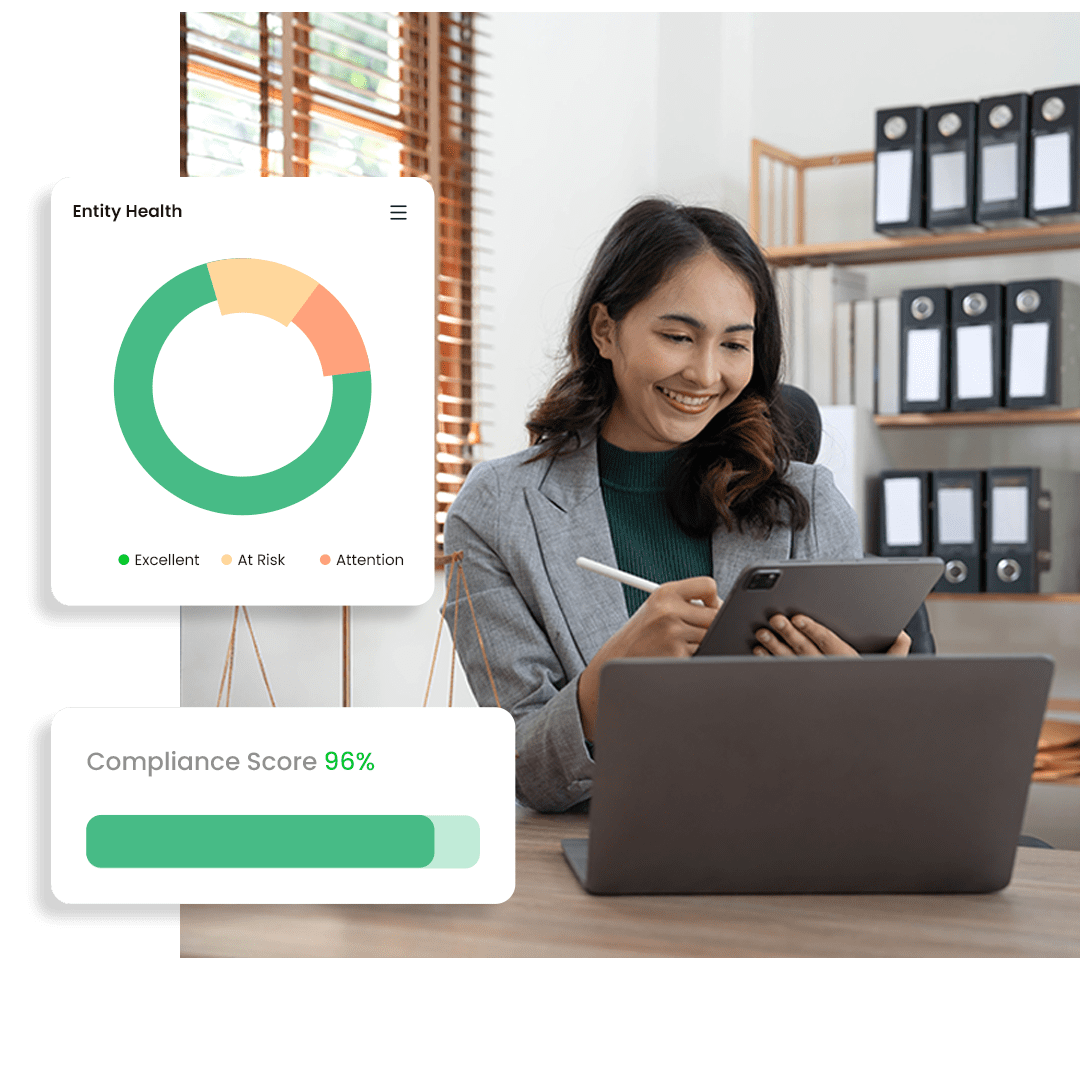

Backed by GateWay, our pioneering global expansion management (GXM) system, we bring an unparalleled focus on the customer experience. By unifying everything you need for cross-border success on a single platform, you can effortlessly and compliantly manage your international footprint.

“While local vendors tend to primarily care about their sliver of the business, HSP Group is, as the single provider, fully invested in the success of the entire organization.”

Head of Finance and Operations at a fast-growing FinTech