M&A Carve-outs

M&A carve-out activity is expected to flourish in the next few years, driven by companies continuing to divest non-core assets to streamline operations and focus on higher-growth areas. Contributing factors include improving economic conditions, lower forecast interest rates and stabilizing inflation, a favorable financing environment encouraging dealmaking, and PE firms holding significant capital they are looking to deploy.

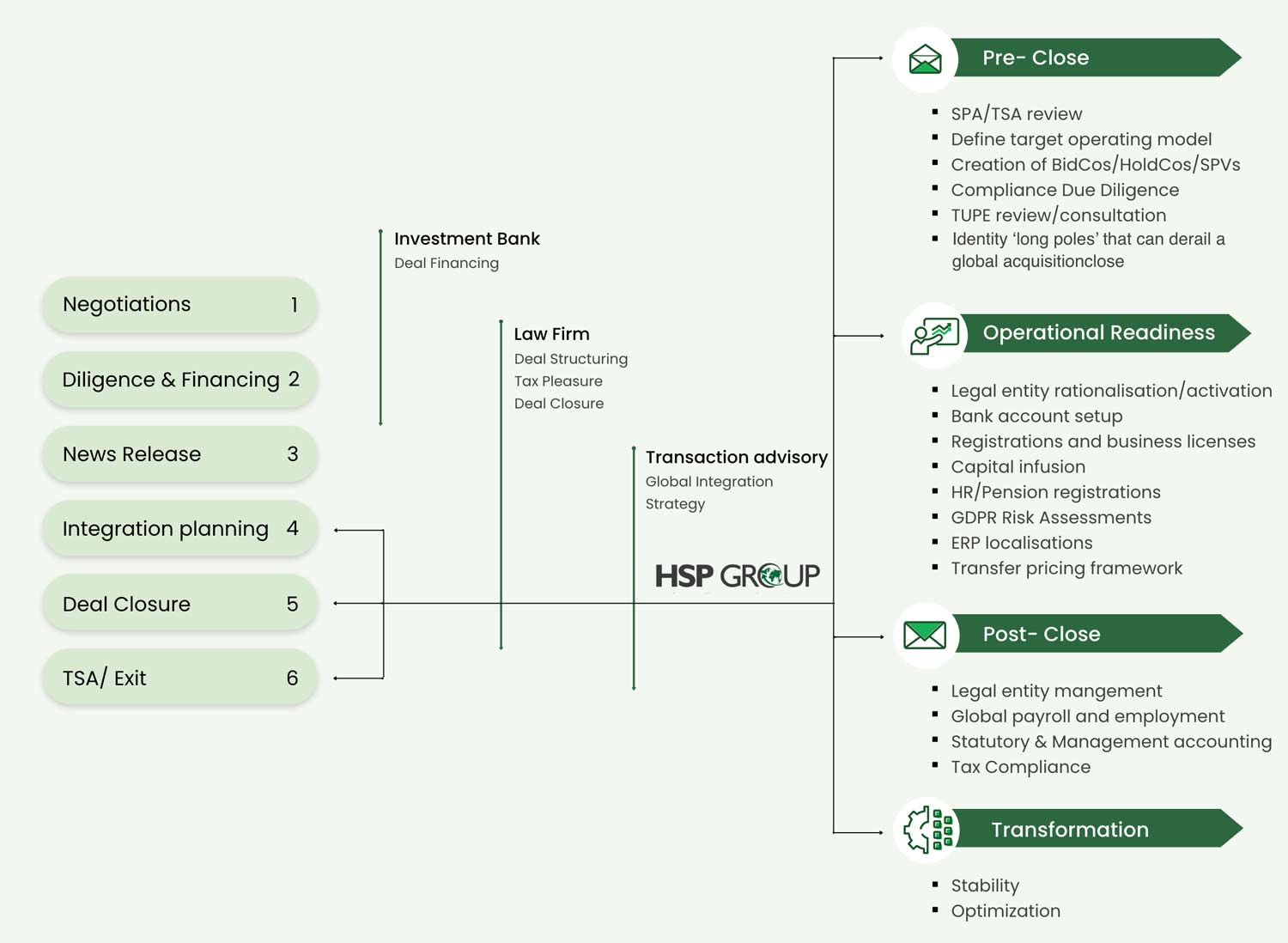

However, growth through M&A is a complicated, risky, and all too often inefficient and costly game – made exponentially more so when the carve-out transaction includes multiple countries. HSP Group, and its team of experienced M&A professionals, specializes in providing unique solutions to this specific challenge.

Proudly Supporting

Why Choose HSP Group for Cross-Border Growth?

End-to-end support for international expansion, M&A,

and operational compliance.

Strategic Global Enablement

HSP Group helps to remove friction in cross-border deals—accelerating speed-to-operation while safeguarding compliance. Whether you’re acquiring assets, launching in a new region, or navigating complex regulatory environments, we provide tailored solutions that match your growth goals.

Operational Expertise Where It Matters

From legal entity setup to post-acquisition workforce onboarding, our expert-led team supports every step of your global journey. We deliver hands-on project management, HR and tax compliance, and localized support in over 100 countries—so your team can focus on growth, not red tape.

A Seamless Global Experience

We’re more than a service provider—we’re an extension of your deal team. With one point of contact and a unified approach, HSP Group ensures your international operations launch cleanly, compliantly, and ready to scale.

HSP experts can help with every stage of your carveout

FEATURED PRESENTATION

The Road to Global Expansion

In this insightful presentation from the Asinta Conference, Michele Museyri, Senior Director of M&A and PE at HSP Group, walks through the strategic and compliance considerations for successful global expansion. Michele shares:

- The benefits and risks of entering new markets

- Key questions to ask before expanding internationally

- Country-specific challenges from France to Japan

- How to navigate local compliance, labor laws, and employment regulations

- Differences between Employer of Record (EOR) and Entity setup

- How to handle international M&A transitions

This session is a must-watch for HR, legal, and business leaders looking to scale globally while staying compliant and competitive.

One Partner for All Your Global Growth Needs

Save time and money while reducing risk by having a single partner manage your company’s global footprint. No other provider offers this full range of services.

Accounting

Accounting

EoR

EoR

EoR to Entity Support

EoR to Entity Support

HR Administration

HR Administration

Global Mobility

Global Mobility

Global Payroll

Global Payroll

Global Payroll Project Consulting

Global Payroll Project Consulting

Legal Entity Management

Legal Entity Management

Tax Compliance

Tax Compliance